Storm Damage or Normal Wear? What Insurance Will—and Won't—Cover

You know your roof took a hit during the storm, but now you're left wondering what your insurance will cover. Is it enough to file a claim? Will they consider it storm damage, or just normal wear and tear? Insurance policies are filled with fine print, and getting coverage often depends on whether the damage meets very specific criteria that aren't always readily apparent.

At Happy Roofing, we've helped many homeowners across the greater Naperville area make sense of what their insurance may cover after a storm. We've seen how subtle the difference can be between legitimate storm damage and general roof wear, and how much that distinction matters when it comes time to file a claim.

In this article, we'll walk you through the differences between normal wear and storm damage, what insurance providers typically cover, and how a proper inspection can give you the clarity (and documentation) you need to move forward with confidence.

Table of Contents

- What Is Normal Roof Wear?

- Normal Roof Wear vs. Storm Damage

- What Roof Damage Will Insurance Cover?

-

How Do Insurance Companies Decide What Roof Damage Is Covered?

-

Is There a Time Limit to File a Roof Damage Insurance Claim?

- Why Do Roof Insurance Claims Get Denied?

- What to Do if Your Roof Has Storm Damage

What Is Considered Normal Roof Wear?

Over time, exposure to sun, wind, rain, and temperature changes naturally causes roof materials to break down. This gradual aging process is considered normal wear and is a routine part of home ownership.

Insurance companies don't view normal wear as something they're responsible for covering. Instead, they expect homeowners to budget for repairs or replacement once a roof reaches the end of its service life. This is typically 15 to 30 years for asphalt shingles, and even longer for more durable materials like metal or slate roofs.

Common signs of normal wear include:

- Fading, cracking, or curling shingles: Constant sunlight breaks down the oils and pigments in asphalt shingles. Over time, this causes protective granules to loosen, the color to fade, the edges to curl, and the surface to crack. These changes happen gradually and evenly across large areas of the roof, which is a telltale sign of aging rather than sudden storm damage.

- Wear concentrated in certain areas: Roof slopes that face direct sunlight for most of the day tend to show aging sooner than other areas. You might notice more curling, cracking, or granule loss on these slopes, while shaded areas or newer sections look less worn. This uneven wear pattern is a classic sign of normal roof aging.

- Gradual loss of granules on shingles: Asphalt shingles are coated with small mineral granules that protect them from UV rays and water. As a roof ages, these granules loosen and wash into gutters after heavy rain. Over time, this makes shingles look smooth or "bald" in certain spots. Granule loss usually happens slowly over many years. If you see a large buildup in your gutters or downspouts, your roof may be nearing the end of its serviceable life, or it can be a sign of underlying issues like poor ventilation.

These signs are all part of normal roof aging. However, if any of them seem excessive, like aggressive curling or lifting shingles, rapid granule loss, or unusually worn sections, it's worth having a professional take a closer look.

While insurance generally won't cover damage from normal wear, staying proactive about your roof's condition can help you address any problems before they turn into more costly repairs.

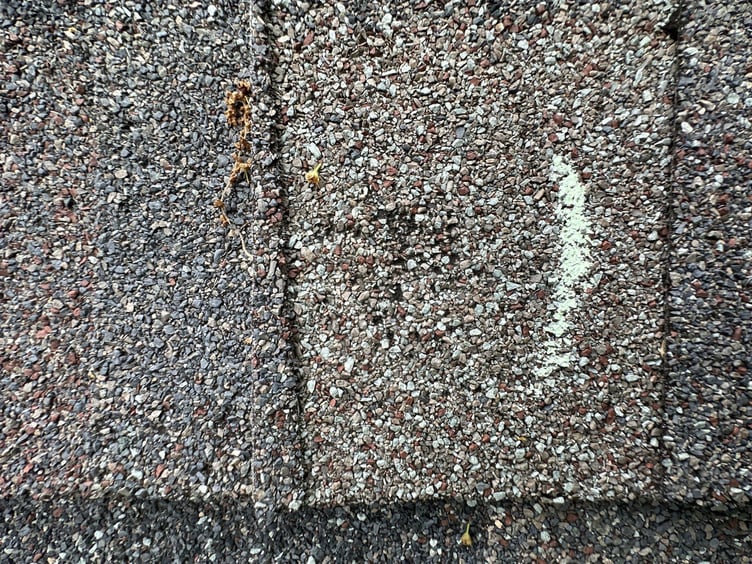

Below is an example of what excessive granule loss can look like:

What Are the Signs of Roof Storm Damage?

Storm damage can range from obvious signs of trouble, like leaks inside the home, to nearly invisible cues like loosened shingles that still appear secure.

Unlike normal wear, storm damage often appears suddenly and in patterns that aren't consistent with natural aging. Here are some of the telltale signs of storm damage:

- Lifted, creased, or missing shingles: Strong winds can break the seal between shingles and lift them, leaving creases or tearing them away entirely. Even if they settle back into place, lifted shingles are more vulnerable to future wind and water damage.

- Damage to gutters, flashing, or siding: Storm impacts can dent gutters, crack flashing, or chip siding. Hail often leaves a random pattern of small, round marks on metal surfaces like vents and flashing, while larger hailstones can cause localized breakage or cracks. Even if your roof appears fine from the ground, these areas can reveal clear signs of storm activity.

- Spots in shingles where granules are missing: Hail impact can knock protective granules loose, exposing the asphalt underneath. These areas may feel softer to the touch compared to the surrounding shingles. Left unaddressed, they can shorten the roof's lifespan and increase the risk of leaks.

- New leaks inside the home: Water stains on ceilings or walls after a storm can indicate that wind-driven rain entered through lifted shingles, compromised flashing, or other storm-related damage. Even small leaks can lead to bigger issues if not addressed quickly.

Experienced roofing professionals know what patterns insurers accept as storm-related damage, and how to document it so your claim has the best chance of approval.

Below is an example of an asphalt shingle that was impacted by hail. At first glance, damage like this can be hard to notice, but any damage to shingle granules can expose the asphalt underneath and risks water intrusion:

Normal Roof Wear Compared to Storm Damage

| Normal Roof Wear | Storm Damage |

|---|---|

| Fading, curling, or cracking shingles that appear evenly across large areas | Lifted, creased, or missing shingles in random or scattered patterns |

| Gradual granule loss over time, often showing up in gutters or bald shingle spots | Sudden granule loss from hail, exposing soft or bare spots on shingles |

| Uneven wear based on sun exposure (e.g., south-facing slopes age faster) | Damage appears suddenly, not tied to sun exposure |

| Cracking or curling from UV breakdown and natural aging | Tears, creases, or punctures from wind, hail, or debris |

| No leaks unless the roof is at the very end of its lifespan | New leaks inside the home after a recent storm |

| Typically not covered by insurance | Often covered by insurance if properly documented |

| Appears gradually and evenly over many years | Appears suddenly and inconsistently after a single storm event |

What Type of Roof Damage Will Insurance Cover?

Most homeowner's insurance policies cover sudden and accidental damage caused by events like hail, high winds, heavy snow, falling branches, or other storm-related impacts.

The key is that the damage must be directly caused by a covered event, you filed within a specified timeframe, and that your roof was in good condition prior to the storm. If both are true, you may qualify for repairs or, in some cases, a full roof replacement.

Here's what's typically included under storm-related roof coverage:

- Repairs or full replacement: Depending on your policy and the extent of damage, your insurer may approve targeted repairs for isolated damage or replace the entire roof if large portions are affected. The decision often comes down to whether repairing small areas would leave the roof uneven in appearance or performance. If repairs would compromise the roof's integrity, or if existing shingles were discontinued and cannot be matched, a full replacement is more likely to be approved.

- Related components: Storms can damage more than just the shingles. Gutters, downspouts, skylights, roof vents, and flashing may also be covered if they were damaged in the same event or if they're necessary for a proper replacement. For example, if hail damage leads to a roof repair, the existing flashing may also qualify for replacement. Reusing old flashing can increase the risk of leaks or other problems in the future.

- Other structures: In some cases, coverage extends to detached garages, sheds, or other structures on the property that were damaged in the storm. Whether these are included depends on your policy language and coverage limits.

While this may sound straightforward, insurance companies require proof that the damage is storm-related and not due to age or neglect. That's where detailed inspection reports complete with photographs, measurements, and clear descriptions, play a critical role in getting your claim approved.

It's important to remember that home insurance covers more than just the roof. A reputable roofing contractor inspecting for storm damage will also check components such as siding and the outdoor AC unit for a clear picture of what was damaged by hail or wind-driven debris. Identifying all affected areas ensures nothing is overlooked in the claim and helps you receive the full coverage your policy provides.

How Do Insurance Companies Decide What Roof Damage Is Covered?

Once you decide to file a claim for roof damage, your insurance company will send an adjuster to your home. The adjuster's job is to verify the damage, determine if it's storm-related, and decide whether or not it's something your policy will cover.

A common method insurance adjusters use to assess impact damage is called the "test square" approach:

- Marking 10' x 10' areas (one square) on your roof: The adjuster will select a representative section on each slope of the roof and outline it in chalk. This square acts as a sample area for assessing the amount of damage that occurred.

- Counting storm-related impacts: Within each square, the adjuster will look for specific signs of storm damage that meet the insurance company's criteria. For hail, this might include round dents in shingles, bruising that feels soft to the touch, or granule loss exposing the asphalt underneath.

- Comparing results to the company's threshold: Every insurance company sets its own standard for how many impacts must be found in a single square for that area to be considered damaged enough to justify repairs, like 8 impacts per square. If the number of qualifying impacts meets or exceeds that threshold, the adjuster will mark that slope as needing repair or replacement.

For wind damage, the process is a bit different. Instead of just using test squares, adjusters inspect the entire roof to find missing shingles, creased shingles, or those that are no longer sealed properly. If the extent of wind damage creates a risk for water intrusion throughout multiple locations on the roof, the insurer may approve replacing the entire roof for consistency and long-term performance.

Tip: Getting a professional roof inspection before filing a claim, and having your roofing contractor present during the adjuster's inspection can be a big advantage. They can point out storm damage the adjuster might overlook and ensure all affected areas, roofing and otherwise, are properly documented for your claim.

Is There a Time Limit When Filing Insurance Claims?

Most policies require you to file a claim within 30 to 60 days of discovering the damage, and sometimes up to 12 months, depending on the provider. This deadline is part of your contract, so always check your specific policy.

In Illinois, if your claim is denied and you decide to file a property damage lawsuit, the state gives you five years to do so. However, your insurance policy may shorten that window with a suit limitation clause, which is legally enforceable as long as it's reasonable.

It's best to file your claim as soon as possible after a storm. Waiting too long can weaken your case and may even disqualify you from coverage under your policy terms.

Why Do Roof Insurance Claims Get Denied?

Insurance claims can be denied for reasons that have nothing to do with the storm itself, like late filing or a lack of regular roof maintenance. Knowing the most common pitfalls can help you avoid them and give your claim the best chance of approval.

- Filing too late: We mentioned this above, but it's a common issue that's worth mentioning again. Most policies require claims to be filed within a set timeframe; miss that window, and your claim could be denied automatically.

- Lack of maintenance: If your roof was already in poor condition before the storm, the insurer may argue that the damage was due to neglect, not the storm. Regular inspections and documented upkeep can help show you've cared for your roof.

- Inadequate documentation: Without clear photos, measurements, and professional reports, it's harder to prove the damage was storm-related even with the adjustor's assessment. The more evidence you can provide, the stronger your case.

- Damage doesn't meet coverage thresholds: For example, hail impacts may need to meet a minimum count in a test square, or wind damage may need to affect a certain percentage of the roof. If the damage falls below that threshold, the insurer may only approve repairs or deny the claim entirely.

- Mixing storm damage with pre-existing issues: If an inspection report doesn't clearly separate new storm damage from older wear or unrelated problems, insurers may classify the bulk of the damage as non-covered wear and tear.

Tip: Work with a contractor who understands the insurance claims process. A qualified contractor will document your roof thoroughly, identify all storm-related damage, and present it in a format that aligns with what insurers need to approve a claim. This can dramatically increase your chances of a fair outcome.

If your claim is denied or you're offered a settlement below your deductible, you still have options:

- Denied claim? Consider hiring a property attorney or public adjuster to advocate on your behalf. They can reassess the damage, challenge the denial, and negotiate with your insurer to help you get the coverage you’re entitled to.

- Underdeductible settlement? Depending on your policy, you may be able to request mediation or demand an appraisal—two legitimate paths to challenge the insurer’s decision.

What to Do if You Suspect Storm Damage

If you suspect your roof has storm damage, the most important thing you can do right now is get a professional inspection. Insurance companies rely on clear, credible documentation to approve claims, and the sooner that documentation is created, the easier it is to connect the damage to a specific storm.

Addressing potential storm damage promptly helps protect your home and get you the best coverage possible. Claim deadlines can be strict, and the sooner damage is documented, the easier it is to connect it to a specific storm. Quick action also helps prevent small issues, like lifted shingles, from developing into more costly repairs over time.

If you're not ready to file a claim right away, you can begin with a professional review of your roof to see the extent of any damage present. This gives you a clear understanding of your roof's condition and helps you decide on the right next steps. We offer non-commitment consultations to give you the clear, honest assessment you need to move forward with confidence.

The Author: Pedro Toledano

Happy Roofing is a trusted roofing company dedicated to providing top-quality roofing services to residential and commercial clients. With years of experience, they specialize in roof installations, repairs, and maintenance, ensuring durability and customer satisfaction. The team is known for their professional approach, timely service, and attention to detail. Happy Roofing prides itself on using high-quality materials and offering competitive pricing. Follow their Facebook page for updates on projects, customer testimonials, and tips on maintaining your roof in excellent condition.